The Definitive Guide to Bandra Bay (2025-2035): Projects, Prices & When to Buy

Mumbai is witnessing its most ambitious waterfront transformation since Nariman Point - Bandra Bay.

Bandra Bay: Mumbai’s Next Great Waterfront Address

Mumbai is witnessing its most ambitious waterfront transformation since Nariman Point - Bandra Bay. Spread across nearly 8 million sq.ft. at Bandra Reclamation, this development marks the city’s evolution into a modern, globally benchmarked coastal destination. With luxury residences, retail promenades, and infrastructure that seamlessly connects to BKC, Worli, and South Mumbai, Bandra Bay is redefining what it means to live by the sea. The skyline rising here isn’t just architectural progress — it’s the future face of Western Mumbai’s elite urban living.

If you’re tracking where Mumbai’s next decade of growth and prestige converge, this is the place to start.

Here’s everything you need to know before investing.

Overview: What Is Bandra Bay?

Bandra Bay is not just a new address - it’s an entirely new urban canvas. Positioned between Mahim Causeway and the Bandra-Worli Sea Link, this stretch of reclaimed coastline at Bandra Reclamation is being reimagined as Mumbai’s most modern and integrated waterfront precinct. Once a utilitarian zone of MHADA housing and open reclamation land, it is now evolving into a rare mix of luxury residences, retail promenades, cultural spaces, and civic infrastructure - the likes of which Mumbai hasn’t seen in decades.

Historically, the area’s transformation began with reclamation projects designed to stabilize the western coastline. Over time, as Bandra grew into the city’s social and commercial nucleus, this underutilized landbank emerged as one of Mumbai’s most strategically valuable zones. The MHADA 2014 base plan (source: CRE Matrix report) outlines the original reclamation grid that now underpins the Bandra Bay master vision. From those state-led plots has risen a developer-led blueprint driven by scale, precision, and private capital.

Geographically, Bandra Bay forms a seamless link between Mumbai’s Western Suburbs and its Central Business Districts. Its proximity to BKC, Worli, and South Mumbai, combined with access to upcoming infrastructure such as the Coastal Road, Metro Line 2B, and the Mumbai-Ahmedabad Bullet Train corridor, positions it as the geographic and economic midpoint of the future city.

Early movers like Adani Realty, Hiranandani, Oberoi Realty, Godrej Properties, and L&T Realtyhave already secured parcels within this corridor — a clear indicator that institutional capital sees this as the next frontier of luxury and land appreciation. Unlike saturated micro-markets, Bandra Bay represents fresh inventory and a master-planned ecosystem anchored on connectivity and coastline prestige.

Internal Link: For a deeper dive into the history of reclamation and its environmental framework, see Bandra Reclamation: History & Environmental Impact.

Vision & Scale: India’s “Marina Bay” Moment

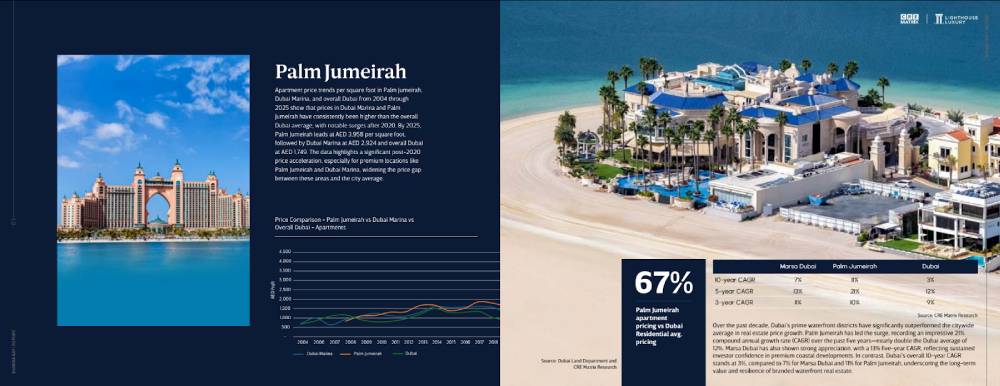

Every city has a defining landmark that reorients its skyline — for Mumbai, that next chapter is Bandra Bay. Conceived as India’s answer to Singapore’s Marina Bay, this ambitious waterfront district blends scale, luxury, and infrastructure in a way that symbolizes Mumbai’s evolution into a global metropolis.

According to the CRE Matrix “Bandra Bay Digital View” report, the development spans roughly 8 million sq.ft. of mixed-use space - a balance of high-end residences, premium retail, and civic infrastructure that’s unprecedented in density and design coherence for the city’s western corridor. Beyond its physical footprint, Bandra Bay represents a new model of urban planning: compact, transit-connected, and architecturally iconic.

At the heart of the vision lies collaboration between top-tier developers - including Adani Realty, Hiranandani, Oberoi, Godrej, and L&T Realty - working alongside municipal and state agencies to create a waterfront comparable to global benchmarks like Dubai Marina and Marina Bay Singapore. The design philosophy emphasizes low-density luxury, sustainable building standards, and seamless integration with public infrastructure such as the Coastal Road and Metro Line 2B.

The scale of investment and coordination makes Bandra Bay far more than a real estate cluster - it’s a symbol of Mumbai’s ambition to redefine urban luxury while opening its western coastline to the public in a curated, high-value way. From skyline silhouettes to waterfront promenades, Bandra Bay is intended to be both a landmark and a legacy - a modern narrative of Mumbai’s rebirth by the sea.

Infrastructure Backbone: The Connective Power

Infrastructure is the single biggest reason Bandra Bay moves from “development” to “market catalyst.” The Coastal Road Phase II, key metro lines, and the Mumbai-Ahmedabad bullet train corridor - as the connective spine that will unlock demand, compress commute times, and lift valuations across the western corridor.

Coastal Road Phase II

Phase II extends the Coastal Road westwards to link Marine Drive with Bandra Reclamation and the Bandra-Worli Sea Link. Budgeted at ₹15,000 crore and designed as a high-capacity arterial, this project creates a largely uninterrupted, low-congestion route along the western edge of the city. For Bandra Bay, the Coastal Road does two things: it converts previously peripheral waterfront parcels into prime, highly accessible real estate; and it provides predictable car travel times to South Mumbai and the business districts that coastal roads currently cannot match.

Metro Lines (2B & 3)

Metro Line 2B and Metro 3 are central transit upgrades for Bandra Bay. These lines directly link Bandra Reclamation to BKC, Dahisar, and Cuffe Parade, creating rapid, grade-separated connectivity for daily commuters and reducing dependence on surface routes. Operationalising these metro corridors turns Bandra Bay into a true transit-oriented neighbourhood - increasing rental demand and shortening effective travel distances for office commuters. (Visual: metro alignment overlay on parcel map.)

Mumbai–Ahmedabad Bullet Train (MAHSR)

While its primary mission is intercity connectivity, the Mumbai-Ahmedabad High-Speed Rail (508 km) corridor has powerful secondary effects for the western corridor. The bullet train will act as a demand multiplier: improved regional connectivity raises Bandra Bay’s profile for national and overseas buyers, increases business travel convenience, and strengthens Mumbai’s role in pan-regional investment flows. Expect the corridor to bolster long-term investor appetite for premium waterfront stock.

Atal Setu, MTHL & Airport Linkages

Complementary projects - the Atal Setu, the Mumbai Trans Harbour Link (MTHL), and improved airport access to the new Navi Mumbai airport - complete the connectivity matrix. These links improve cross-bay movement and diversify access routes, reducing single-route risk and supporting higher price confidence for new waterfront supply.

Recommended visuals for this section

- Infrastructure timeline (2025-2035): phased milestones for Coastal Road II, Metro 2B/3, MAHSR, Atal Setu, MTHL.

- Commute Time Matrix: side-by-side “Current vs Post-Build” travel times to BKC, Worli, and South Mumbai.

Internal link: Read the detailed breakdown in “How the Coastal Road & Metro Will Rewire Bandra Bay.”

Developers & Projects: The New Skyline

Bandra Bay’s skyline will be defined as much by who builds it as by what’s built. CRE Matrix’s mapping of the reclamation shows a concentrated roster of marquee developers and curated boutique players - a mix that guarantees both scale and architectural variety. The report lists Adani Realty, Hiranandani Communities, Oberoi Realty, Godrej Properties, L&T Realty, plus a number of specialist residential and hospitality players that have secured parcels across the reclamation. Together they form a tightly controlled pipeline of premium product designed for HNIs, NRIs and executive occupiers.

Development scale & typology

CRE Matrix quantifies the Bandra Bay pipeline at roughly 8 million sq.ft. of residential + retail - a mix of low-density waterfront towers, podium-style amenity blocks and curated retail frontages built around a continuous promenade. Parcel acreages in the report show multiple sub-acre to half-acre plots (example callouts: 0.25-0.5 acres with 80-170 unit footprints) that intentionally limit supply and preserve exclusivity. This is deliberate: the master plan favours smaller, high-value parcels rather than mass housing, which supports pricing resilience.

Developer table (snapshot)

Below is a compact table you can drop straight into the page or CMS. Where the report names a specific project, it’s listed; where it does not, the entry reads “Residential (Bandra Bay parcel)”. Possession columns use the report’s current status where available; otherwise the cell notes “Stage: Planned / Under development (see developer dossier)”.

| Developer | Project | Typology | Possession / Stage | Est. psf (guide) |

|---|---|---|---|---|

| Adani Realty | Residential (Bandra Bay parcel) | Waterfront residential | Stage: Planned / Under development. See dossier. | ₹80,000-₹1,25,000 / sqft. |

| Hiranandani Communities | (Project listed in report) | Luxury residential, low-density | Stage: Planned / Under development. | ₹80,000-₹1,25,000 / sqft. |

| Oberoi Realty | Residential (Bandra Bay parcel) | Ultra-luxury residences | Stage: Planned / Under development. | Market band per report; sea-facing premium applies. |

| Godrej Properties | Residential (Bandra Bay parcel) | Premium residential | Stage: Planned / Under development. | ₹80,000–₹1,25,000 / sqft. |

| L&T Realty | Residential / Mixed-use | Mixed-use waterfront | Stage: Planned / Under development. | Market band per report. |

| DLH / Inspira / Elements / Excel Infra / Gurukrupa / Raveshia | Various named projects (e.g., Bellissima, Bay Heights, Inspira One, The Marque) | Boutique + mid-luxury parcels | Staged across launch windows | Project-level psf in report tables. |

| Taj / Wadhwa Group | Hospitality / Commercial frontages | Hotel & retail nodes | Planned hospitality & commercial parcels | N/A — commercial rent comps shown in report. |

What to read into the table

- Low-density intent: many parcels in the report are intentionally small (0.25-0.5 acres) with unit counts between ~80-170 - that’s a supply strategy aimed at exclusivity and price support.

- Pricing band: Bandra Bay is within the upper luxury band (guideline range ₹80k-₹1.25L per sqft on carpet), with sea-facing premium expected to push select product above the high end.

- Pipeline concentration: the mix of national developers (Adani, Godrej, L&T, Oberoi) and specialist/residential players creates diversification in product types while keeping supply curated.

Lifestyle & Neighbourhood Essentials

Bandra Bay isn’t only a collection of towers — it’s designed to be a neighbourhood you actually use. The master plan layers high-end housing onto an everyday ecosystem: schools, hospitals, retail, promenades and cultural anchors that make waterfront living practical as well as prestigious.

Education is well-served within easy reach. Premium options such as Dhirubhai Ambani International School and the MET Institute anchor the schooling map for families, making Bandra Bay viable for long-term residents, not just short-term investment buyers.

Healthcare proximity is a core comfort factor. Major hospitals including Lilavati and Hinduja (Khar) are the closest tertiary care options, guaranteeing access to specialist services and emergency care - an important consideration for HNIs and families evaluating quality of life alongside asset value.

Retail and leisure cluster around two poles: traditional Bandra shopping on Linking Road and the large-scale retail/entertainment draw of Jio World Drive. Bandra Bay’s curated retail frontages are planned to complement — not compete with — these established destinations, creating a seamless shopping and dining circuit.

For recreation and culture, the plan folds in the Sealink Promenade and easy routes to Bandra Fort and local performance spaces. Public promenades, pocket parks and landscaped open spaces are woven through the precinct to ensure walkability and year-round public access to the waterfront.

Practical living details - micro-mobility lanes, dedicated pick-up zones, and green buffer zones between residential blocks and the promenade - are built into the master plan to preserve both privacy and public amenity.

Investment Thesis: Why HNWIs Are Eyeing Bandra Bay

For high-net-worth investors, Bandra Bay checks every decisive box - location, scarcity, prestige, and long-term liquidity. CRE Matrix positions the precinct as a once-in-a-generation opportunity: a limited coastline, brand-led development, and infrastructure that rewires the city’s west-to-south connectivity.

Drivers of value

Bandra Bay sits at the midpoint of Mumbai’s growth triangle: BKC, Worli, and South Mumbai. With immediate access to the Coastal Road, Metro Lines 2B & 3, and Atal Setu. Unlike vertical clusters elsewhere, this micro-market’s land parcels are capped by reclamation boundaries, creating natural scarcity. Every unit built here adds structural value simply because no further seafront land can be replicated. Add to that the city’s top developer brands and the psychological premium of new waterfront living, and Bandra Bay’s positioning becomes self-reinforcing.

Projected returns & liquidity

Based on historical appreciation of similar luxury corridors and CRE Matrix’s forward modeling, investors can expect an annualized IRR in the 10-14% range, with upside tied to early-phase entry and sea-facing exposure. Liquidity is healthy for this price band: most units transact through a small, cash-rich buyer pool, ensuring price stability even during softer cycles. For NRIs, demand stems from rental viability (executive leasing tied to BKC and Worli) and capital appreciation potential on repatriation.

Risks & considerations

No luxury precinct is risk-free. Bandra Bay’s early-stage status means construction timelines, policy shifts, and environmental compliance (CRZ, reclamation permissions) are factors to track. Investors should focus on projects with sea-facing inventory above 50%, as these retain superior resale traction.

Market Snapshot & Price Trends

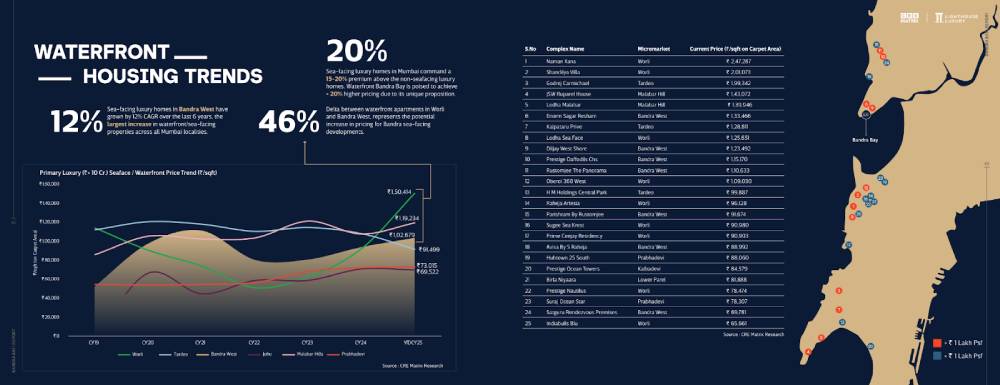

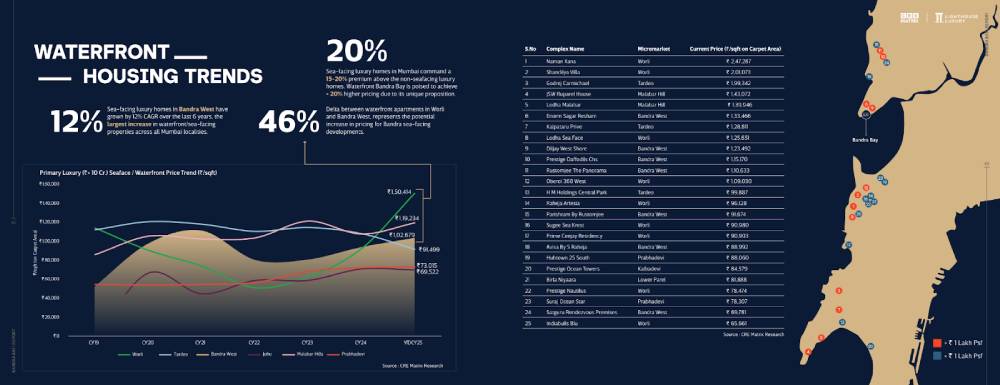

Bandra Bay is positioned at the top end of Mumbai’s luxury market, not just by branding but by measurable economics. CRE Matrix places the combined Bandra Bay pipeline and nearby luxury stock into a clear premium bracket, and three headline metrics define the market story for buyers and investors today.

1. Luxury share vs. value (2025)

Although luxury units comprise only 4% of units sold, they represent 17% of total transaction value in the catchment, a stark concentration of value into a very small share of supply. That imbalance explains why developers and investors are intentionally curating supply: a few scarce, high-price units move a large portion of market value and therefore set headline pricing for the neighbourhood.

2. Recent price momentum

High-ticket apartments (₹10 crore and above) have recorded ~15% YoY price growth across 2023-2025. This growth is most pronounced for newly launched, well-positioned sea-facing inventory and projects that advertise low-density planning and premium amenities. For HNIs, that momentum is evidence of both robust demand and a market still discovering its equilibrium.

3. Sea-facing premium

CRE Matrix quantifies the sea-facing premium at 15-20% over comparable non-seafacing product within the same project — a material uplift that alone can justify a several-crore delta on unit price in new launches. Developers are pricing waterfront line-ups with this premium built in, and resale comps have begun to reflect those bands.

Bandra Bay vs Worli vs Juhu - a practical comparison

Per the report, Bandra Bay sits at the apex of the local price ladder: guide bands for premium product are published in the report at approximately ₹80,000-₹125,000 per sq.ft. (project/sea-facing variation applies). Worli remains an established luxury market with deep secondary liquidity and selective ultra-luxury stock - it’s broadly comparable but typically trades at a slight discount to newer, branded Bandra Bay product because Bandra Bay’s master-planning and new infrastructure reprice the waterfront narrative. Juhu retains a unique lifestyle premium driven by legacy sea-facing villas and established neighbourhood cachet; select Juhu sea-facing stock can match Bandra Bay pricing, though much of Juhu’s broader inventory sits below the Bandra Bay luxury band.

Buyer Checklist & Legal Basics

Buying in Bandra Bay demands precision. Transactions at this scale require both compliance and clarity. Here’s what every prospective buyer — domestic or NRI — should confirm before signing.

RERA & approvals:

Ensure the project is registered under Maharashtra RERA (MahaRERA). Cross-verify that title documents and building plans are cleared, and that Coastal Regulation Zone (CRZ) norms are adhered to - essential for waterfront projects.

Title & due diligence:

Obtain a Title Search Report through an independent legal firm. Developers listed in the CRE Matrix report (Adani, Hiranandani, Oberoi, Godrej, L&T) maintain clean RERA histories, but legal vetting remains critical for resale security.

Taxation & duties:

For properties above ₹10 crore, expect 6% stamp duty (Mumbai) and 5% GST on under-construction units. Ready-to-move-in inventory attracts no GST but retains standard registration costs.

NRI & FEMA compliance:

NRIs can freely purchase residential property (other than agricultural land) under FEMA regulations using NRE/NRO accounts. Repatriation of sale proceeds is permissible after meeting lock-in and tax clearance requirements. For investments exceeding FEMA thresholds, a CA certificate (Form 15CA/CB) is required.

Documentation checklist:

- RERA Registration Certificate

- Title & Encumbrance Certificate

- CRZ Clearance Letter

- Allotment Letter & Agreement for Sale

- Payment receipts & GST challans

Future Outlook (2025-2035)

The next decade will define Bandra Bay’s transformation from blueprint to benchmark. The CRE Matrix Bandra Bay Digital View report outlines a clear sequence of milestones that will convert infrastructure investment into real estate absorption and long-term value creation.

Key milestones ahead:

2025-2026: Coastal Road Phase II completion, connecting Marine Drive to Bandra Reclamation — the single most transformative infrastructure link for the western coastline.

2026-2027: Metro Lines 2B and 3 begin operations, integrating Bandra Bay directly with BKC, Worli, and Cuffe Parade.

2027-2028: First residential handovers in early parcels; visible occupancy brings liquidity and secondary market benchmarks.

2028-2029: Atal Setu and cross-bay access to MTHL operational, enhancing connectivity to Navi Mumbai and the new international airport.

2030-2035: Complete waterfront activation with public promenades, hospitality projects, and cultural spaces.

As these layers mature, CRE Matrix projects a sustained price appreciation trajectory, with luxury asset values growing in line with absorption. Bandra Bay’s limited supply and infrastructural edge are expected to support above-market returns through the early 2030s, outpacing most of Mumbai’s western corridor in both per-square-foot value and capital efficiency.

The Mumbai Urban Plan 2035 identifies Bandra Bay as a “critical western growth anchor” - a bridge between historic South Mumbai and the emerging economic districts of BKC and Wadala. Its role extends beyond real estate: it represents a reorientation of Mumbai toward the sea, balancing density with liveability.

“Bandra Bay will be remembered as Mumbai’s defining urban experiment - a living proof that world-class infrastructure can create world-class real estate,” says Abhishek Kiran Gupta, Co-founder, CRE Matrix. (Source: CRE Matrix - Bandra Bay Digital View Report)

Visual recommendation: Include a Timeline Graphic (2025-2035) plotting infrastructure completions, first possessions, and projected market milestones. (Credit: CRE Matrix)

Check out what Dr. Niranjan Hiranandani thinks of Bandra Bay -

FAQs

Bandra Bay lies along the western coastline of Mumbai, between Mahim Causeway and the Bandra-Worli Sea Link, within the Bandra Reclamation precinct. It forms part of the western waterfront, connecting directly to BKC, Worli, and South Mumbai through upcoming infrastructure projects like the Coastal Road and Metro Line 2B.

Yes. Bandra Reclamation refers to the reclaimed land created for public and residential use decades ago. Bandra Bay is the new, master-planned development within this reclaimed zone — envisioned as Mumbai’s modern waterfront district featuring luxury housing, retail, and open public spaces.

According to the CRE Matrix Bandra Bay Digital View Report, leading developers include Adani Realty, Hiranandani Communities, Oberoi Realty, Godrej Properties, and L&T Realty, among others, collectively shaping nearly 8 million sq.ft. of luxury and mixed-use development.

Premium residences at Bandra Bay are priced between ₹80,000 and ₹1,25,000 per sq.ft., depending on location, sea-facing orientation, and brand positioning.

Coastal Road Phase II, connecting Marine Drive to Bandra Reclamation, is expected to be fully operational by 2026, according to the CRE Matrix report.